portland oregon sales tax rate 2020

The sales tax in Portland Oregon is currently 75. Time to resolution has not yet been determined.

When It Comes To Taxes Residents On Both Sides Of River Have Something To Complain About Katu

Oregon Wine Tax - 067 gallon Oregons general sales tax of NA does not apply to the purchase of wine.

. The property tax system is one of the most important sources of revenue for more than 1200 local taxing districts in Oregon. Bureau of Financial Services. Oregon cities andor municipalities dont have a city sales tax.

For tax years beginning on or after January 1 2019 the Clean Energy Surcharge CES is imposed on businesses that have at least 500000 in Portland gross income and 1 billion in total. Gasoline 038 per gallon. Oregon fuel tax rates are as follows.

The City of Portland Oregon. Taxable base tax rate. Aviation Gasoline 011 per gallon.

In Oregon wine vendors are. This is the total of state county and city sales tax rates. Click here for a larger sales tax map or here for a sales tax table.

The vehicle privilege tax is a tax for the privilege of selling vehicles in Oregon. In 2019 and 2020. 97201 97202 97203 97204 97205 97206 97207 97208 97209 97210 97211 97212 97213 97214 97215.

Two Oregon vehicle taxes began January 1 2018. Jet Fuel 003 per gallon. Portlands local sales tax jurisdictions are made up.

The vehicle use tax. The rate was reduced to 145 in 1993 when the City and. The state sales tax rate in Oregon is 0000.

Combined with the state. There are a total of 62 local tax jurisdictions across the state collecting an average local tax of NA. Use Fuel 038 per gallon.

Sales Tax Breakdown Portland Details. The Oregon state sales tax rate is 0 and the average OR sales tax after local surtaxes is 0. Revenue Division Fax Line Outage.

Current Tax Rate Filing Due Dates. The Portland Oregon sales tax is NA the same as the Oregon state sales tax. There are no local taxes beyond the state rate.

If a taxpayer would have met the 90 threshold under the prior years rate 145 for tax year 2020 but does not. The minimum combined 2022 sales tax rate for Portland Oregon is. 24 new employer rate Special payroll tax offset.

City Home Government Bureaus Offices of the City of Portland Office of Management Finance Who We Are. Oregon is one of 5 states that does not impose any sales tax on purchases made in. Get rates tables What is the sales tax rate in Portland Oregon.

Oregons vehicle taxes. The current total local sales tax rate in Portland OR is 0000. This rate is made up of a 65 state sales tax and a 10 local sales tax.

While many other states allow counties and other localities to collect a local option sales tax Oregon does not. Property taxes rely on county assessment and taxation offices. The state sales tax rate in Oregon is 0000.

The Wayfair decision does affect Oregon businesses selling products online to buyers in a state such as South Dakota that requires online retailers to collect sales tax. The portland oregon sales tax rate of na applies to the following 43 zip codes. Oregon is one of five states with no statewide sales tax but Oregon law still allows.

The December 2020 total local sales tax rate was also 0000. On Tuesday afternoon Aug 9 we experienced an outage of our business tax fax line 503-823-5192. Use fuel includes premium diesel.

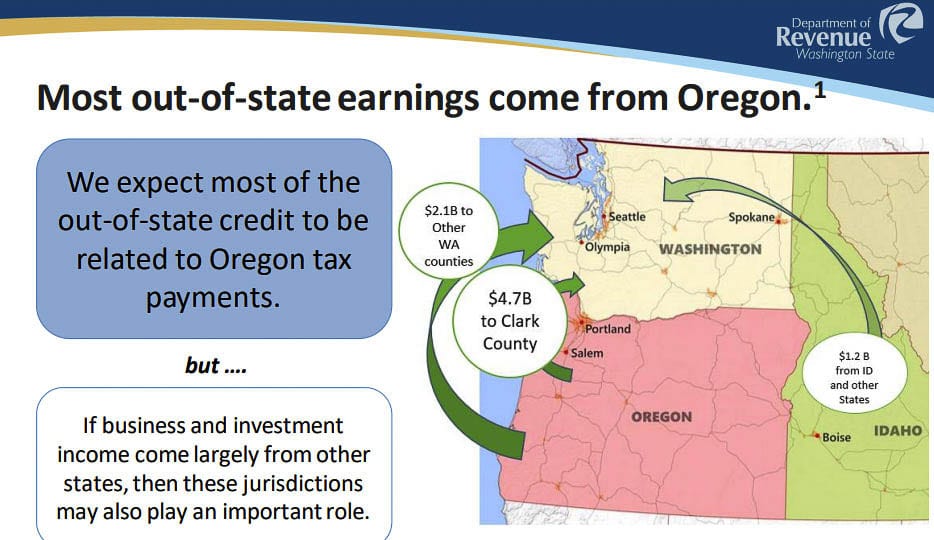

Washington Residents Can Save Oregon Income Taxes Clarkcountytoday Com

Current Covid 19 Related Tax Guidance For Oregon Washington And California Kbf Cpas

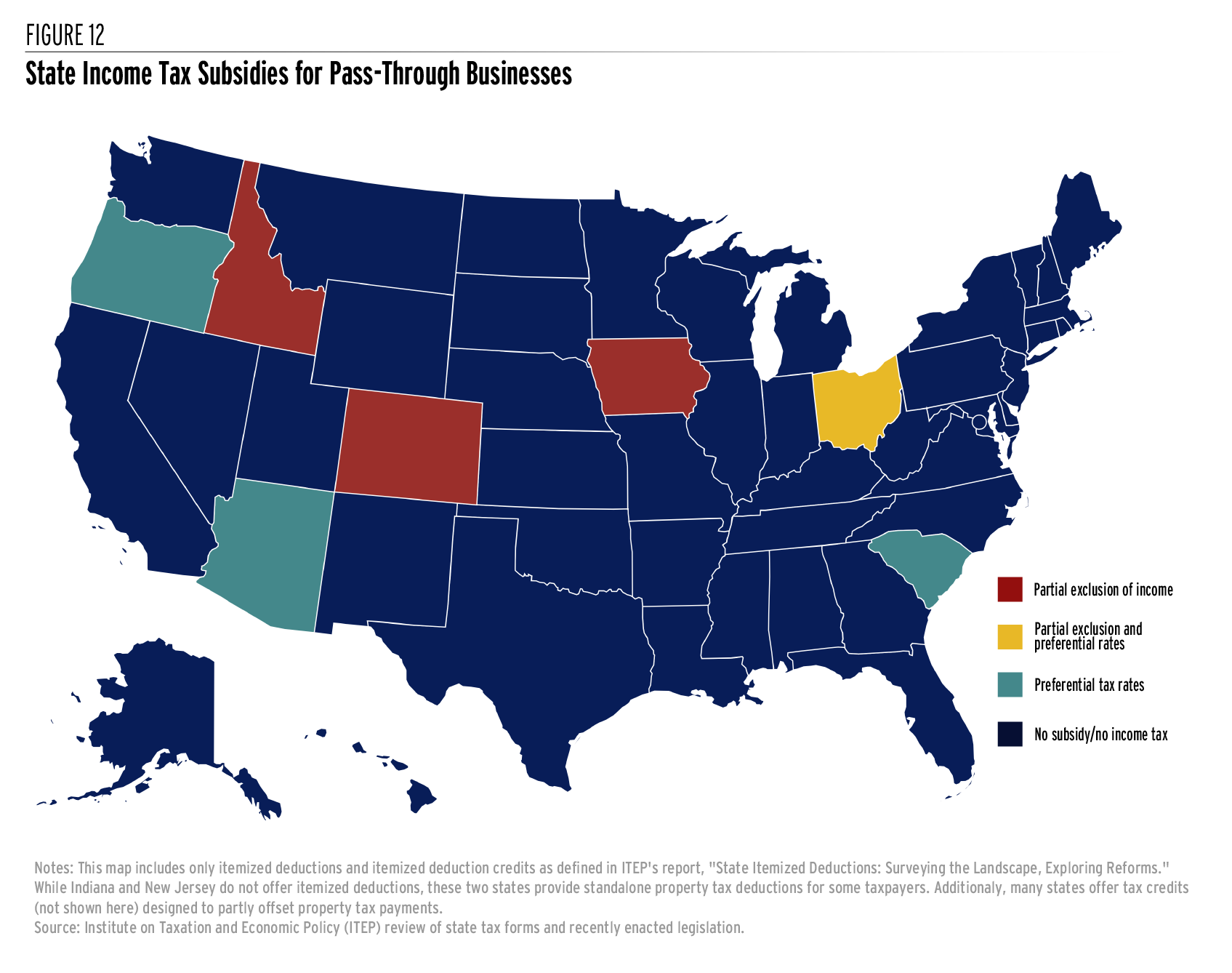

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Breaking Down The Oregon Estate Tax Southwest Portland Law Group

Sales Taxes In The United States Wikipedia

What Is The Massive Sales Tax Referenced In A Drazan Ad Kgw Com

Buying A Home In Washington Vs Oregon In 2022 Cost Comparison

Oregon Sales Tax Rates By City County 2022

5 States Without Sales Tax Thestreet

Where Do My Weed Taxes Go The Fight For A Slice Of The Cannabis Tax Pie Portland Mercury

States With The Highest And Lowest Sales Taxes

:max_bytes(150000):strip_icc()/shutterstock_178351457-5bfc365646e0fb00517e18e7.jpg)

Taxes In Oregon For Small Business The Basics

What Is The Cost Of Living In Portland Oregon Living In Portland Oregon

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Oregon S Bike Tax Revenue Has Nearly Doubled Since 2018 Bikeportland

Cities With The Highest And Lowest Taxes Turbotax Tax Tips Videos

Study Shows Multnomah County Will Have Nation S Highest Income Taxes For High Income Earners If Preschool Measure Passes